Thinking about updating your bathroom but unsure how to finance it? The best way to pay for a bathroom remodel in Houston depends on your financial situation and the scope of the project. Options include personal loans, home equity loans or lines of credit, contractor financing programs, or paying with cash from savings. For smaller projects, saving up or using credit cards might be sufficient, while larger remodels may require leveraging home equity or taking out a personal loan.

Here's a breakdown of common financing options:

| Financing Option | Best For | Pros | Cons |

| Cash | Small to medium projects | No interest, simple | Requires upfront funds |

| Home Equity Loans/HELOCs | Larger, equity-rich projects | Low rates, tax deductible (sometimes) | Risk to home, longer approval |

| Personal Loans | Quick cash without equity | Fast, unsecured | Higher interest rates |

| Contractor Financing | Bundled with project cost | One-stop, flexible terms | May include project markups |

| Credit Cards | Small, immediate needs | Easy access | High interest, risk of debt |

Key Takeaways

- Understand your total project scope: The size and complexity of your bathroom remodel in Houston will greatly influence the best financing route.

- Home equity financing suits larger remodels: Houston homeowners with substantial equity can benefit from low-interest options like home equity loans or HELOCs.

- Personal loans offer speed and flexibility: Ideal for moderate projects when you want fast approval without tapping into your home’s value.

- Contractor financing provides convenience: Some local remodelers, like Keechi Creek Builders, offer bundled financing programs with customized payment plans.

- Cash remains the least complicated option: If you’ve saved enough, paying upfront keeps things simple and avoids interest fees.

Cash: The Simplest Way to Pay for Your Houston Bathroom Remodel

Using cash from your savings is often the cleanest and most straightforward way to fund your bathroom upgrade. This approach eliminates debt, interest, and monthly payments. Plus, you’ll have full control over your budget from day one.

When paying with cash makes sense:

- Small to mid-sized bathroom projects

- Cosmetic updates like new fixtures, paint, or flooring

- Homeowners with a dedicated remodeling savings fund

Houston Tip: Many local bathroom remodelers offer discounts for clients paying in full with cash, so be sure to ask about potential savings.

Home Equity Loans and HELOCs: Tapping Into Your Home’s Value

If your bathroom remodel involves significant upgrades—like layout changes, high-end materials, or luxury features—then using your home equity could be a smart choice.

Home Equity Loan: This option gives you a lump sum upfront with fixed monthly payments. It's great for projects with clearly defined budgets, like a full master bath remodel.

HELOC (Home Equity Line of Credit): Works more like a credit card, letting you draw funds as needed over time. HELOCs typically offer variable interest rates but can provide flexibility if your project timeline spans several months.

Important Considerations for Houston Homeowners:

- Many neighborhoods like The Woodlands, Cypress, and Memorial have seen rising property values, making home equity financing a viable choice for residents in these areas.

- Always consult with a local Houston lender to understand current interest rates and borrowing limits based on your home’s appraisal.

Risk Note: Remember, these loans use your home as collateral. If you fail to repay, you could risk foreclosure.

Personal Loans: Fast, Flexible, and No Home Collateral Needed

Personal loans are a popular choice for Houston homeowners seeking quick, unsecured funding. Approval processes are typically faster than mortgage-related loans, and the funds can often be used for any purpose—including your bathroom renovation.

Benefits of Personal Loans:

- Fixed monthly payments for easier budgeting

- No need for home equity

- Often available within a few business days

Common Uses for Personal Loans in Houston Bathroom Remodels:

- Mid-range bathroom updates costing between $10,000 and $30,000

- Projects where speed is essential, like fixing urgent plumbing or water damage

- Homeowners with good to excellent credit looking for low interest rates

Houston Tip: Local banks and credit unions sometimes offer special home improvement loan packages with better rates than national lenders.

Contractor Financing Programs: An All-in-One Solution

If you’re looking for convenience and simplicity, contractor financing may be a great fit. Many Houston-based remodeling firms, including Keechi Creek Builders, partner with third-party financing companies to offer payment plans directly to their clients.

Advantages:

- Streamlined application during your project planning phase

- Flexible repayment terms tailored to your budget

- Potential promotional offers, like deferred payments or low-interest introductory periods

Watch Out For: Contractor financing sometimes comes with higher interest rates or built-in project markups. Always compare their terms with your personal bank loan offers.

Local Insight: Given Houston’s competitive remodeling market, many contractors are increasingly offering attractive financing packages to stand out.

Credit Cards: Quick Access for Smaller Remodel Projects

For minor bathroom updates—like installing new light fixtures, adding storage solutions, or upgrading faucets—using a credit card might be an easy short-term solution.

Benefits of Using Credit Cards:

- Immediate access to funds

- Opportunity to earn rewards or cashback

- Useful for bridging funding gaps on larger projects

Downsides:

- High interest rates if not paid off quickly

- Risk of accumulating long-term debt

Houston Tip: Look for credit cards offering 0% APR promotional periods on purchases for 12 to 18 months. This can help you spread out costs without interest if you pay within the promo window.

Additional Funding Options Houston Homeowners Should Consider

Beyond traditional financing and cash, here are a few other ways to pay for your bathroom remodel:

- Tax Refunds: Many homeowners use their annual IRS refund toward home improvement projects.

- Work Bonuses: Applying your end-of-year or performance bonus toward your bathroom remodel can reduce the need for loans.

- Dedicated Savings Accounts: Set up a "bathroom remodel fund" and contribute monthly until you reach your goal.

- Insurance Claims: If your bathroom remodel involves repairing storm or water damage, check if your homeowners insurance covers part of the cost.

- DIY Where Possible: Reduce costs by handling small tasks like demolition or painting yourself.

- Seasonal Sales: Take advantage of Houston area sales events—like Memorial Day or Labor Day sales—for discounts on materials and fixtures.

Factors to Consider When Choosing a Bathroom Remodel Financing Option

Before committing to any payment method, evaluate these critical factors:

- Project Size and Scope: Larger, more complex remodels often require structured financing. Small projects may fit within your monthly cash flow or savings.

- Your Monthly Budget: Choose a financing option with monthly payments you can comfortably afford over the long term.

- Interest Rates and Loan Terms: Shop around with multiple Houston lenders for the most competitive rates and flexible terms.

- Upfront Costs and Fees: Be aware of origination fees, closing costs (for home equity products), or hidden contractor charges.

- Your Available Equity: If choosing a home equity product, ensure your home has sufficient equity and that you’re comfortable leveraging it.

- Approval Timeline: If your remodel is urgent (like fixing a bathroom after flood damage), faster funding options like personal loans or credit cards may be necessary.

Conclusion

Choosing the best way to pay for your bathroom remodel in Houston comes down to understanding your financial situation, project size, and long-term goals. Whether you opt for a home equity loan, personal loan, contractor financing, or cash from savings, the key is to select the option that balances affordability and flexibility.

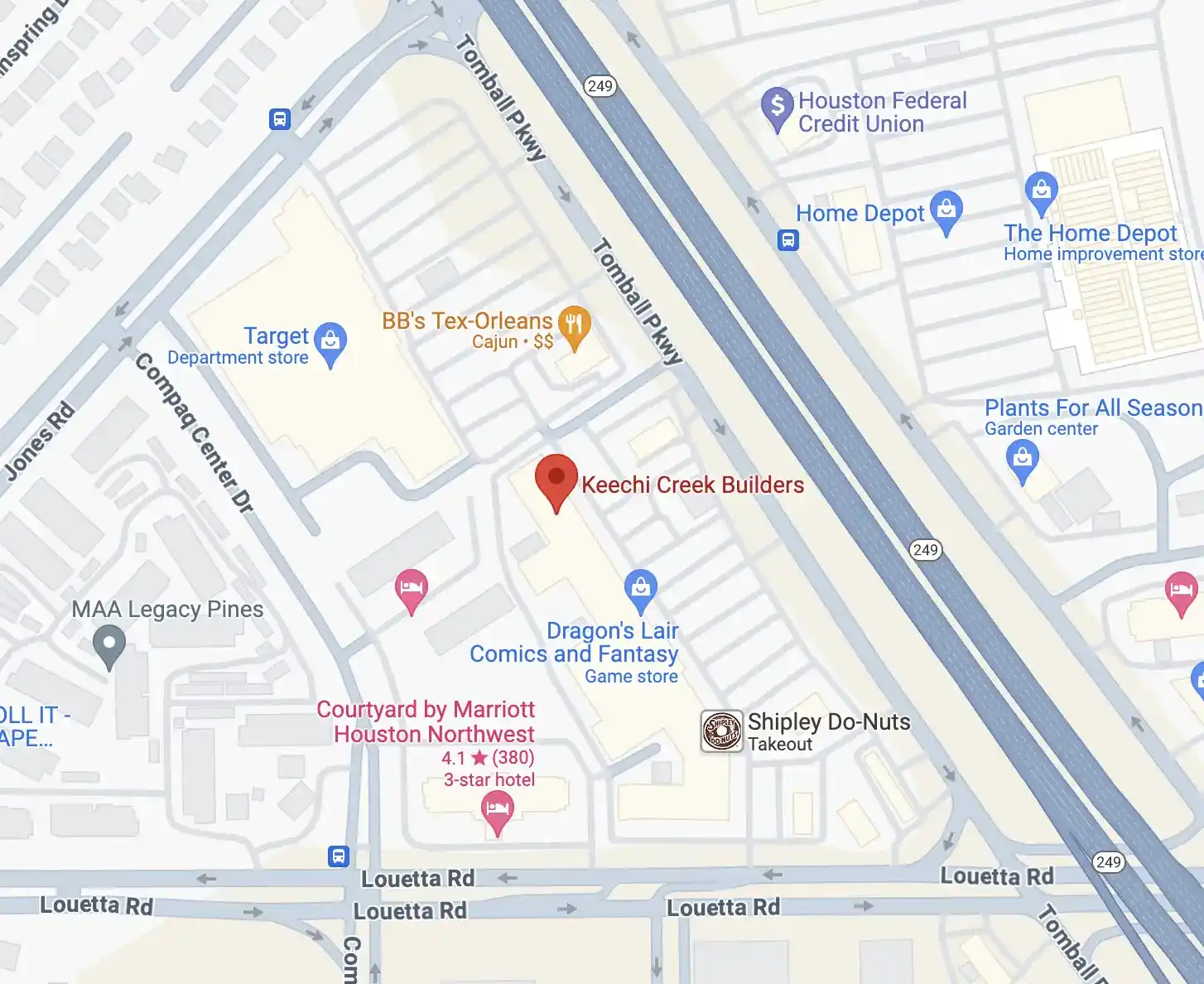

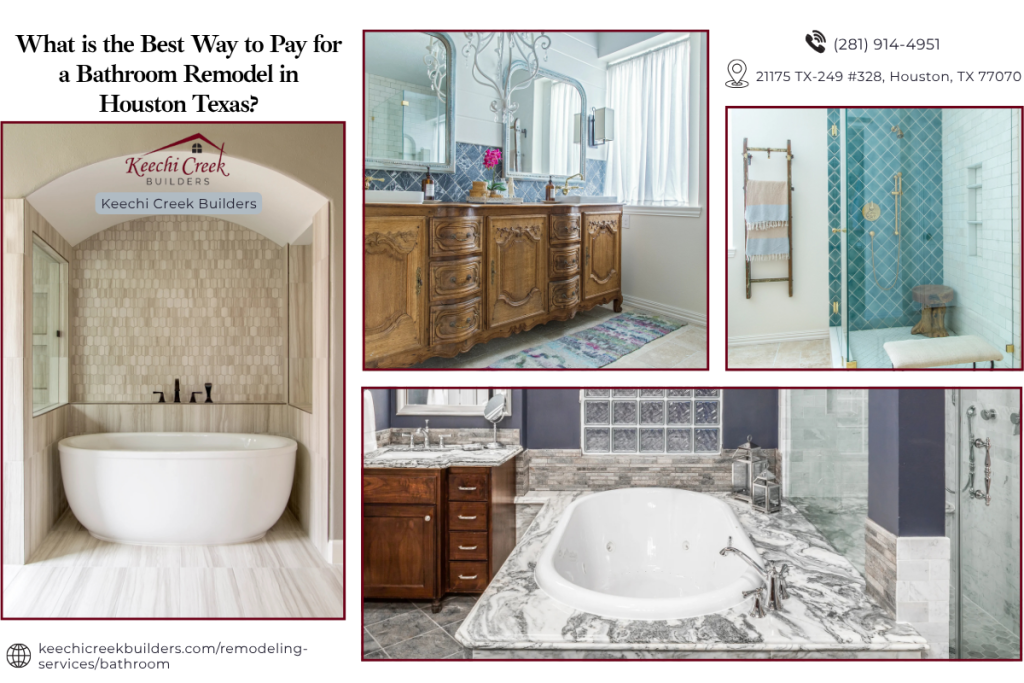

If you’re ready to bring your vision to life, Keechi Creek Builders is here to help. Located at 21175 TX-249 #328, Houston, TX 77070, this award-winning design/build firm specializes in luxury bathroom remodels tailored to your lifestyle and budget. Reach out today for expert guidance and financing options that work for you.

![prism2023 winner logo[8]](https://files.keechicreekbuilders.com/2024/11/prism2023-winner-logo8-e1731607791571.webp)